JOIN THE PROJECT CARGO & BREAKBULK INDUSTRY IN THE WORLD’S ENERGY CAPITAL

Across the Americas, the energy project market is booming. To tap into project opportunities, there’s no better place than Breakbulk Americas in Houston – it’s where project decisions are made and home to Port Houston, the nation’s largest port for waterborne tonnage and our host port.

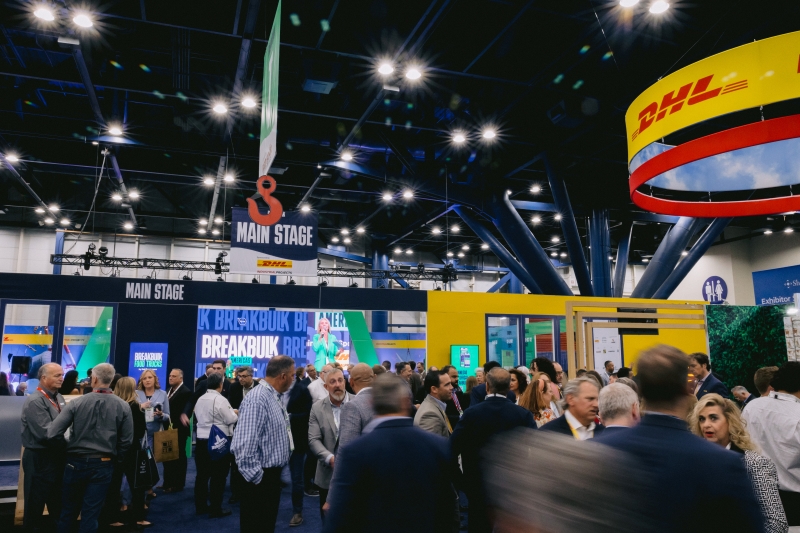

Breakbulk Americas is the region's largest and longest-running trade event for the industry. Over the course of three days, you’ll make new connections with representatives from the entire supply chain, representing the key players in Canada, the U.S., Mexico and throughout Latin America. This is the must-attend event for anyone seeking new business opportunities in the global market.

2025 Stats Brochure

Breakbulk Americas celebrated its 35th anniversary with record-breaking success - welcoming over 6,250 attendees, 440 global shippers, and 330 exhibitors. Industry professionals from 68 countries joined us in Houston, with 48 out of 50 US states represented. This milestone edition also witnessed record-high numbers for the After-Party at The Rustic, the Women in Breakbulk Networking Luncheon and Education Day - a key indication of the event's future growth.

Why Breakbulk Americas?

Showcase your company

Build connections that last

Increase brand awareness

What’s on?

For Shippers

Breakbulk’s Global Shipper Network for the Americas draws from the world’s top energy companies and EPCs. We offer a full menu of benefits for network members.

See them all

For Women

Our program has expanded to include a 2-hour networking and learning session on Tuesday, plus a Women in Breakbulk Lounge on the show floor for meetings and conversation throughout the show. Learn more about the Women in Breakbulk Americas program and sign up to receive all the latest news.

Sign up

For Everyone

Our conference agenda is developed in collaboration with the Breakbulk Americas Advisory Board, including thought leaders from a variety of sectors to ensure the program covers the topics industry professionals need to know to make the best strategic decisions.

View 2025 agendaTestimonials

Be First in Line for Breakbulk Americas 2026

The biggest gathering for project cargo and breakbulk professionals is returning in 2026. Don’t miss your chance to connect with industry leaders, explore new opportunities, and shape the future of logistics.

Industry Insights

Women in Breakbulk Confront Reshoring Realities

US Power Sector Boom Tests Rail, Heavy Haul Limits

Surging Minerals Demand Powers Growth in Logistics

Using Tech To Tackle Breakbulk Bottlenecks

Shippers Steady as Tariffs Bite

Breakbulk Carriers Weather the Storm

Women in Breakbulk: Collaboration Takes Center Stage

Tariffs: Beyond the Fear Factor

Join the Breakbulk Community

Breakbulk Global Shipper Network

The Global Shipper Network is an exclusive network of senior breakbulk and project cargo owning shippers involved in the engineering, manufacturing and production of industrial projects and project cargo. Access exclusive learning and networking opportunities and join today! JOIN THE GLOBAL SHIPPER NETWORK

Global Event Partners

If you do business in more than one region in the world, your marketing program should reflect your coverage. The Global Event Partner program is designed to support your business goals through our three events in Dubai, Rotterdam and Houston. Become a Global Event Partner to maximise your reach to key decision-makers. BECOME A GLOBAL EVENT PARTNER

Women in Breakbulk

Become a member of the Women in Breakbulk networking group to stay in contact with other members all year round. Fill out the form and be sure to include your photo and advice to other women. All members receive free entry to the Women in Breakbulk Lounge at Breakbulk Americas and early access to tickets. JOIN THE COMMUNITYFrequently Asked Questions

There are multiple ways to get involved. Join us as a visitor, exhibit to showcase your solutions, or consider sponsorship to gain maximum visibility. Learn more about exhibiting.

Breakbulk Americas 2026 will take place on September 22 -24 2026 in Houston, Texas. The venue is George R. Brown Convention Centre, 1001 Avenida De Las Americas, Houston, TX 77010.

Breakbulk Americas attracts over 5,600 professionals from across the globe, enabling you to meet with companies large and small from all parts of the supply chain, including shippers. You’ll also meet the specialized transporters, project forwarders and other service providers that fulfil critical roles on project teams.

We offer a variety of advertising opportunities, including ads in Breakbulk Magazine (distributed at the event), BreakbulkONE (our monthly newsletter), and website banner ads. These options help expand your reach before, during, and after the event. See the Media Kit and talk to your sales representative.

The BGSN is a global community of cargo owners involved in the logistics and transportation of oversized, heavy-lift, and project cargo. To maintain the integrity of this network and ensure it delivers value to its members, BGSN tickets are reserved exclusively for professionals who:

-

Represent companies that own, produce, or procure cargo (e.g., EPCs, OEMs, energy companies, mining firms, etc.)

-

Are directly responsible for project logistics, procurement, or supply chain decisions involving breakbulk and project cargo

-

Do not provide third-party logistics, freight forwarding, or supply chain services to cargo owners

If your company does not fall within this category, we would still love to welcome you to the event with as a visitor, which offers full access to the exhibition floor, networking opportunities, and content sessions.

.png?ext=.png)

.jpg?ext=.jpg)

.jpg?ext=.jpg)

_1.jpg?ext=.jpg)

_3.jpg?ext=.jpg)

_1.jpg?ext=.jpg)

.jpg?ext=.jpg)

_1.jpg?ext=.jpg)

.png?ext=.png)

_3.png?ext=.png)

.jpg?ext=.jpg)